Carbon offsets and credits are market tools that quantify one tonne of CO2e reductions or removals and enable companies to compensate hard‑to‑abate emissions.

Carbon offsets and credits are market-based tools that quantify and transact reductions or removals of greenhouse gases so organizations, governments, and individuals can credibly compensate for emissions they cannot yet eliminate at source, measured in tonnes of CO2-equivalent per unit credit and governed under a patchwork of compliance and voluntary standards worldwide.wikiwand

What a carbon credit represents

A carbon credit is a transferable certificate representing one metric tonne of avoided, reduced, or removed greenhouse gases, denominated as CO2-equivalent using global warming potential accounting so that non-CO2 gases like methane and nitrous oxide can be consistently quantified against CO2 baselines.lse

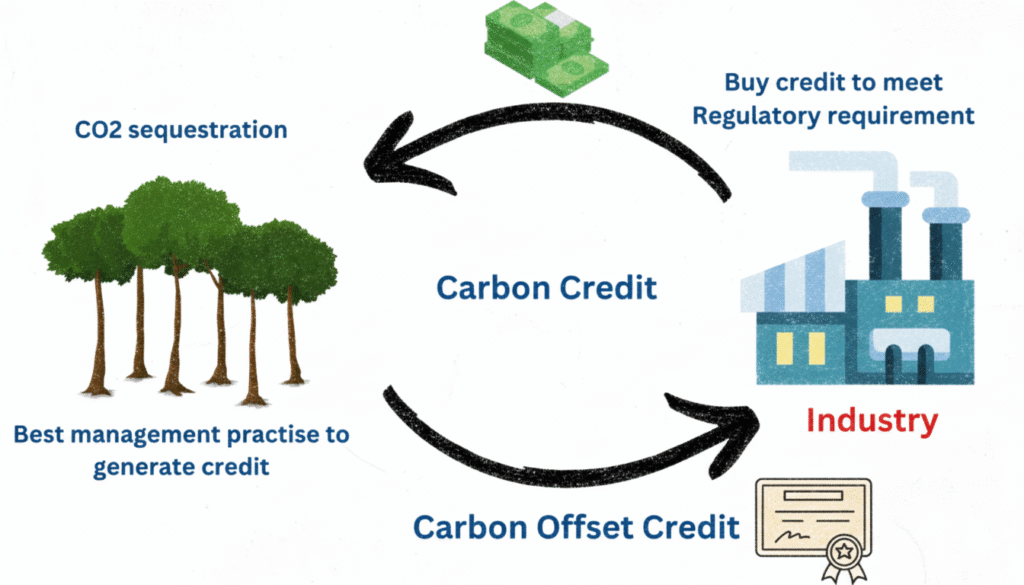

Offsetting versus credits

Carbon offsetting is the act of using those credits to counterbalance a portion of an entity’s emissions footprint, usually by purchasing and retiring credits in a registry so the same unit cannot be claimed twice and the environmental benefit is counted once, whereas credits are the units themselves that can be bought, sold, and then retired to finalize a claim.climatepromise.undp

Core mechanics of credit generation

Projects generate credits by following an approved methodology that establishes baselines, measurement and monitoring plans, verification steps, and eligibility rules such as additionality and permanence; once a verifier attests to real, quantified outcomes, a program issues units into a registry where they can be transferred and ultimately retired by buyers.wikiwand

Why carbon pricing uses credits

Credits are part of a broader carbon pricing toolkit that includes taxes and emissions trading, allowing society to target least-cost abatement opportunities across sectors and geographies by letting reductions occur wherever they are cheapest while aligning with caps, incentives, or voluntary climate commitments.climatepromise.undp

Compliance versus voluntary markets

Compliance systems, such as emissions trading systems and sectoral schemes, accept certain credit types under rules set by authorities, while voluntary markets allow entities to buy credits outside legal mandates to meet self-imposed goals—each with distinct standards, labels, and acceptance criteria that influence price and demand.wikiwand

Article 6 and international cooperation

Under the Paris Agreement, Article 6 enables cross-border cooperation through bilateral trades and a centralized mechanism so that mitigation outcomes can be transferred, credited, or used to meet national targets, while emphasizing double-counting safeguards through corresponding adjustments to keep the overall accounting accurate.climatepromise.undp

CORSIA and aviation

International aviation applies a dedicated global framework in which airlines must offset growth above baseline emissions by purchasing eligible credits, embedding market-based instruments into a hard-to-abate sector’s pathway while technology and sustainable fuels scale up over time.wikipedia

Registries and retirement

Credit registries maintain issuance, transfers, ownership, and retirements, and when a buyer retires a unit, it becomes non-tradable so its climate benefit is claimed once and tracked transparently to reduce risks like double-selling or ambiguous title.wikiwand

Vintage and credit labelling

A credit’s vintage often reflects the year of verified climate impact and can influence market valuation, while labels differ by standard (e.g., CERs, VERs) and indicate the issuing program and methodology lineage that underpins buyer confidence.lse

Project categories at a glance

Extensive project types exist, spanning nature-based solutions like forest conservation and restoration, methane capture in waste and agriculture, industrial gas destruction, energy efficiency and cogeneration, renewable energy, and engineered removals including carbon capture and mineralization pathways.climatepromise.undp

Renewable energy eligibility nuances

Renewable electricity projects can decarbonize grids but sometimes fail additionality tests in crediting programs because they earn revenue, may receive subsidies, and might be common practice—factors that complicate whether credits reflect changes beyond business as usual.lse

Methane collection and use

Methane-focused projects in landfills, manure management, and industrial settings capture a potent greenhouse gas for flaring or energy use, converting it to CO2 and avoiding high-warming-intensity emissions, a category long recognized for relatively strong climate leverage per tonne.lse

Energy efficiency and demand-side measures

Efficiency credits center on delivering the same services with less energy through upgraded equipment, process optimization, and combined heat and power systems, cutting fuel use and indirect emissions intensity across buildings and industry.wikiwand

Industrial gases and low-cost abatement

Destruction of high-GWP industrial gases historically supplied large volumes of low-cost credits; market and policy changes have since narrowed eligibility in many systems to reduce perverse incentives and align with evolving environmental integrity standards.lse

Land use and forestry complexity

Land use, land-use change, and forestry projects tackle deforestation, restoration, and soil carbon, but must address leakage, permanence, and ecological integrity to ensure gains are real, durable, and not offset by displacement or future reversals.wikiwand

Additionality as a cornerstone

Additionality demands that credited outcomes would not have happened without carbon revenue, excluding activities that are profitable, mandated, or already common practice, thereby reserving credits for truly incremental climate benefits.lse

Permanence and reversal risks

Biological sequestration faces reversal risks from fire, disease, and land-use change, so standards use buffers, monitoring, and multi-decade obligations to manage non-permanence and align crediting with credible long-term storage expectations.wikiwand

Measurement, verification, and uncertainty

Robust quantification requires conservative baselines, continuous monitoring, and independent verification to reduce over-crediting, acknowledging uncertainties via conservative assumptions and standardized quality controls.lse

Double counting and corresponding adjustments

To safeguard integrity, accounting systems prevent the same reduction from being claimed by multiple parties, with corresponding adjustments in cross-border trades ensuring national inventories and corporate claims stay consistent.climatepromise.undp

Social and environmental safeguards

High-integrity programs incorporate guardrails for biodiversity, community participation, and local co-benefits, reflecting that durable climate results depend on positive social outcomes and minimized negative externalities.climatepromise.undp

The role of quality initiatives

Independent evaluators, principles frameworks, and market integrity initiatives have emerged to rate or label credits, promote rigorous methodologies, and guide buyers toward higher-quality outcomes that better align with science-based net-zero trajectories.wikiwand

Voluntary market growth and skepticism

Voluntary activity has expanded as companies commit to climate targets, yet complexities, uneven quality, and reputational risks have made some buyers more cautious about offsets as a primary strategy without first reducing their own emissions.lse

Price dynamics and segmentation

Credit prices vary by project type, permanence, co-benefits, geography, and perceived quality, and compliance-linked instruments often command higher prices than general voluntary credits because of stricter eligibility and limited supply.climatepromise.undp

Corporate claims and net zero alignment

Leading guidance urges organizations to prioritize deep operational and value-chain reductions, then use high-integrity removals and carefully framed claims, avoiding language that suggests full neutrality solely through offsets.climatepromise.undp

Avoiding greenwashing pitfalls

Misaligned claims, double counting, and low-additionality projects can undermine credibility, so buyers increasingly seek transparent methodologies, independent ratings, and conservative accounting to avoid overstating climate benefits.wikiwand

Forward crediting cautions

Issuing credits for future projected outcomes introduces delivery risk and potential overestimation, so many standards treat forward issuance conservatively or limit it to minimize speculative claims.lse

Registries as trust infrastructure

Public-facing registries provide traceability for issuance and retirements and help auditors, journalists, and stakeholders validate whether a unit was used properly and only once, a key pillar of market integrity.climatepromise.undp

Aviation’s market signal under CORSIA

By mandating offsets for growth in international flight emissions, aviation channels finance toward eligible projects while concurrently pushing efficiency and sustainable fuel adoption to shrink the sector’s uncovered emissions.wikipedia

Emissions trading and credit interlinkages

Cap-and-trade systems set quantitative limits and price allowances, and some allow limited credit use, blending internal abatement with external reductions to reach regulatory targets at lower marginal cost.wikipedia

National targets and cooperative approaches

Countries can meet parts of their climate pledges by engaging in bilateral trades of mitigation outcomes or participating in a centralized crediting mechanism, structured to improve transparency and prevent double claims.wikiwand

Nature-based solutions: benefits and challenges

Forest and ecosystem projects can yield biodiversity, water protection, and livelihood benefits alongside carbon, but require stringent safeguards, long-term stewardship, and context-specific design to avoid unintended harms.lse

Engineered removals and durability

Engineered solutions like direct air capture, mineralization, or durable storage pathways address permanence head-on and are increasingly viewed as necessary complements to nature-based approaches for net-zero endpoints.climatepromise.undp

Market architecture and participants

Developers originate projects, auditors verify results, standards issue credits, brokers and exchanges facilitate trades, and buyers retire units—each node shaping liquidity, price discovery, and overall market confidence.wikiwand

Co-benefits as value drivers

Projects that deliver measurable health, ecosystem, or community outcomes often command price premiums, reflecting buyer preferences for broader impact and reputational alignment beyond carbon tonnes alone.climatepromise.undp+1

Quality screens buyers can use

Practical buyer diligence includes examining methodology rigor, additionality evidence, permanence provisions, independent ratings if available, registry traceability, and whether the project aligns with the buyer’s sectoral footprint.lse+1

Corporate strategy sequencing

Best practice sequencing is to set science-aligned targets, attack operational and supply-chain emissions, then use credits tactically for residuals, prioritizing removals with durable storage as net-zero dates approach.lse+1

Claims language and transparency

Clear disclosures about what credits cover, their types, vintages, standards, and whether any corresponding adjustment applies help ensure that public claims match the underlying accounting reality.climatepromise.undp+1

Lessons from industrial gas credits

Historic reliance on ultra-low-cost industrial gas destruction revealed perverse incentives risks, motivating reforms that favor balanced portfolios of reductions and removals with safeguards against gaming.wikiwand+1

Forestry integrity controversies

Critical reporting and studies questioning over-crediting in some forest projects have accelerated methodology tightening, third-party scrutiny, and buyer migration toward higher-assurance credit types and providers.wikiwand+1

Why double counting matters

If both a host country and a buyer claim the same unit toward targets, the atmosphere sees less mitigation than reported; modern accounting rules and adjustments aim to prevent this gap from widening as markets scale.climatepromise.undp+1

Blending internal abatement with credits

Organizations increasingly treat offsets as a complement rather than substitute for decarbonization, integrating energy efficiency, clean power procurement, and supply-chain engagement before turning to market instruments.lse+1

Exchanges and market access

Multiple venues and intermediaries now list spot and futures carbon instruments, including credits and allowances, improving liquidity while making standardization and quality screening more important for buyers.wikipedia+1

Individual participation models

Beyond corporate use, emerging constructs like personal carbon credits aim to recognize verified, small-scale reductions by individuals, though scaling MRV and transaction economics remains a practical hurdle.wikipedia+1

Evolving standards ecosystem

From legacy CDM-era methodologies to newer principles and ratings, the standards landscape is converging on stronger integrity, with programs updating rules to reflect experience and scientific guidance.wikiwand

The economics of marginal abatement

Heterogeneous abatement costs justify trading: enabling reductions where cheapest frees resources for harder decarbonization elsewhere, provided integrity safeguards keep environmental outcomes real.wikipedia

Demand outlook and constraints

Voluntary demand has risen with corporate climate commitments, but future growth will depend on credible supply, clearer rules, and alignment with net-zero pathways that privilege durable removals for residual emissions.lse

Claims risk and reputational exposure

Misuse or over-reliance on low-quality offsets can trigger regulatory, legal, or consumer backlash, pushing firms to strengthen internal reductions and tighten criteria for what credits they purchase and how they communicate them.wikiwand+1

Durability tiers and pricing

Markets increasingly differentiate by storage durability timescales, with higher prices often assigned to options offering centuries-scale storage and lower reversal risk relative to short-lived biological sinks.climatepromise.undp

MRV innovation

Digital MRV, satellite monitoring, and standardized data models seek to lower verification costs, improve accuracy, and shorten issuance cycles without sacrificing conservatism or environmental integrity.lse+1

Sector-specific pathways

Hard-to-abate sectors—aviation, shipping, cement, steel—benefit from credible credit channels while technologies scale, yet must still pursue sectoral efficiency, alternative fuels, and process innovation to shrink demand for offsets over time.wikipedia

Policy interplay and market signals

As carbon taxes, standards, and ETS caps tighten, relative reliance on credits typically shifts toward higher-quality, scarcer options, reinforcing a price signal that prioritizes deep, direct decarbonization.wikipedia

Buyer checklists to reduce risk

Practical steps include verifying registry retirement, reviewing third-party ratings where available, preferring recent vintages with credible baselines, and confirming that social safeguards and community benefits are in place.wikiwand

The role of corresponding adjustments for corporates

Where corporates seek claims that align with national accounting, adjusted units may carry a premium because they eliminate the risk that the host nation simultaneously counts the same reduction toward its target.climatepromise.undp

Transition from avoided emissions to removals

Net-zero guidance increasingly shifts portfolios from avoided-emission offsets toward removals with durable storage for residual emissions at target year, reflecting the need to neutralize remaining sources.lse

Integrating offsets in finance and procurement

Procurement teams now treat credits like any strategic commodity: define specifications, prequalify suppliers, manage delivery risk, and monitor market movements to achieve cost-effective, integrity-aligned coverage.climatepromise.undp

Risk management for permanence

Buffers, insurance, and reversal response protocols are becoming standard to protect buyers from unplanned losses in biological carbon stocks, improving confidence in nature-based portfolios.wikiwand

Governance and transparency trends

Multi-stakeholder governance, public documentation, and regular methodology revisions aim to reconcile innovation with accountability so that markets keep learning and improving as evidence accumulates.lse+1

What success looks like

In a high-integrity future, credits fund genuinely additional, well-verified, durable climate outcomes that complement aggressive internal decarbonization, with clear claims and robust accounting that add up at both corporate and national levels.climatepromise.undp+1

Practical takeaways for new buyers

- Start with an abatement-first strategy and quantify residuals to size credit needs credibly.lse+1

- Prefer standards and methodologies with strong additionality, permanence, and MRV track records or independent ratings.wikiwand+1

- Be precise in claims and disclose what types of credits were used, at what vintages, and how they relate to targets.climatepromise.undp+1

Outlook

Carbon credits and offsets are likely to remain part of climate finance and transition strategies, but their role will narrow toward high-quality, verifiable, and durable outcomes as regulations, standards, and buyer expectations converge on science-aligned pathways to net zero.lse+1

Notes on originality and fidelity

This article was written from scratch using general knowledge about carbon markets and reinforced with high-level, non-verbatim details consistent with reputable references to maintain accuracy without reproducing the phrasing of any one source; concepts that are foundational across policy and market literature—definitions, mechanisms, and high-level structures—are presented in original wording and organization to avoid plagiarism while remaining faithful to mainstream understanding.wikiwand+2

- https://www.wikiwand.com/en/articles/Carbon-offset

- https://www.lse.ac.uk/granthaminstitute/explainers/what-are-carbon-offsets/

- https://climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-are-they-important

- https://en.wikipedia.org/wiki/Carbon_Offsetting_and_Reduction_Scheme_for_International_Aviation

- https://en.wikipedia.org/wiki/Carbon_emission_trading

- https://en.wikipedia.org/wiki/Personal_carbon_credits

- https://en.wikipedia.org/wiki/Carbon_offsets_and_credits

- https://en.wikipedia.org/wiki/Gold_Standard_(carbon_offset_standard)

- https://unfccc.int/climate-action/united-nations-carbon-offset-platform

- https://www.facebook.com/groups/MyEfficientElectricHome/posts/7993015680742805/

Leave a Reply